Corporate tax filing

Enhance Your Business with Expert Tax Advice

Managing tax season can be daunting, particularly for businesses adapting to ever-evolving tax laws and regulations. Our team of experienced Certified Public Accountants has in-depth expertise in business tax compliance. Through our personalized approach, we’ll refine your tax strategy to maximize deductions, credits, and savings, helping your business achieve financial success.

How Manay CPA Can Assist You

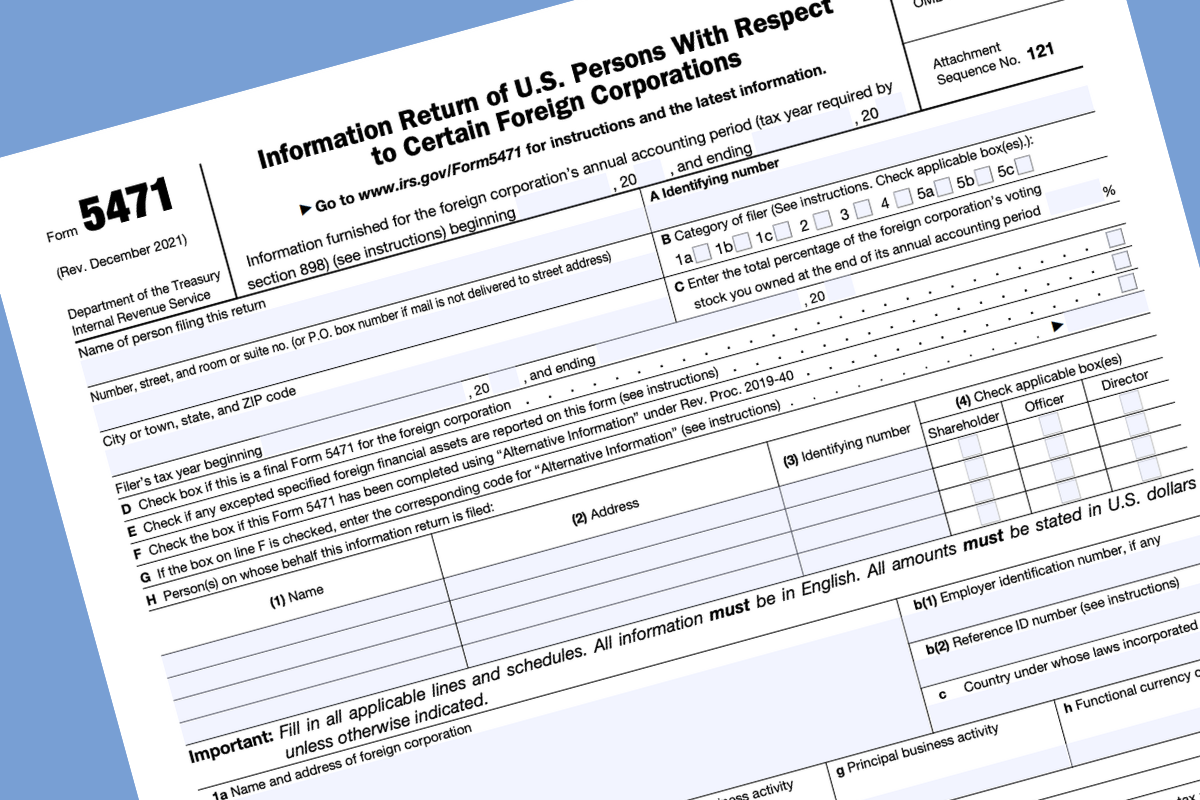

Filing of Form 5471

If a senior taxpayer is a qualifying U.S. citizen, corporation, partnership, trust, or estate with at least 10% ownership in a foreign corporation, they may be required to file Form 5471, the Information Return of U.S. Persons with Respect to Certain Foreign Corporations. Our team will assist in determining your filing requirements and ensure the form is completed accurately and thoroughly.

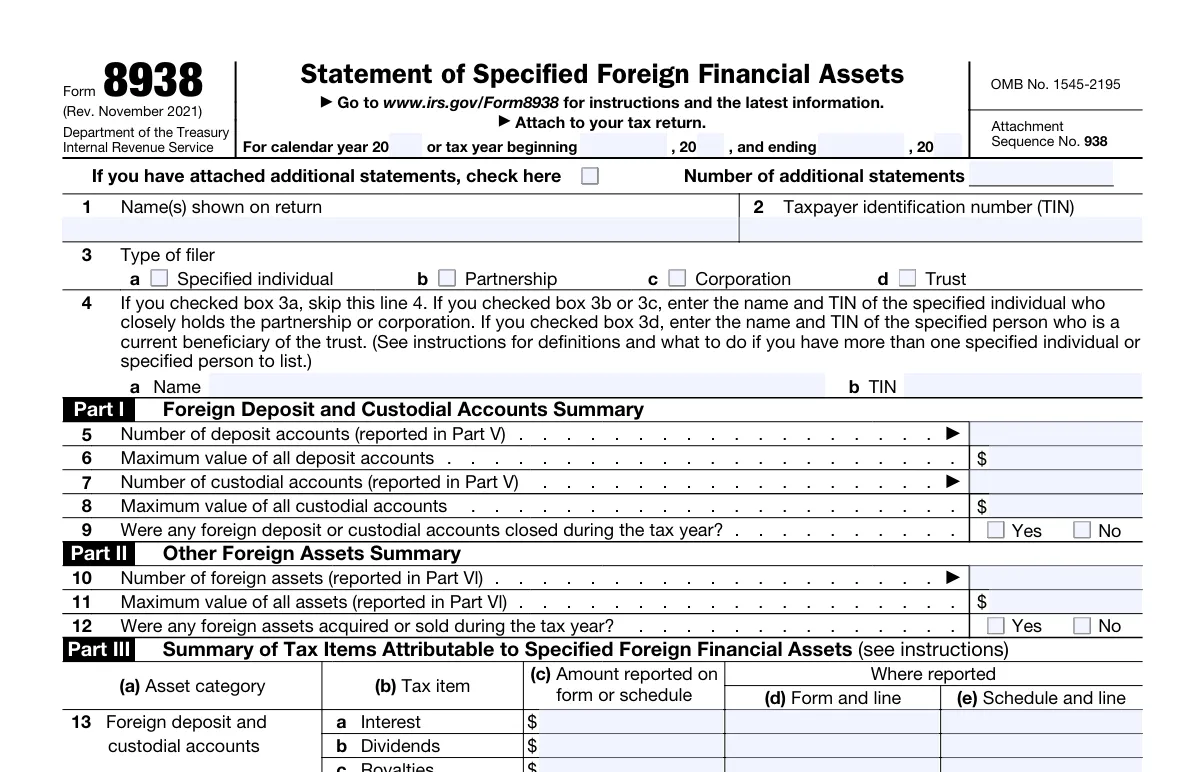

Filing of Form 8938

If you are a senior U.S. citizen residing abroad, you may still have U.S. tax obligations on certain foreign assets and might be required to file Form 8938 annually. Form 8938, the Statement of Specified Foreign Financial Assets, applies to U.S. taxpayers living overseas who hold foreign assets exceeding a certain total value, such as foreign pension plans or shares in foreign companies. At Manay CPA, we will assist you in determining whether this form applies to your tax situation and guide you through the filing process.

Creating Projected Financial Statements for E-1 and E-2 Visa Applications

E-1 Treaty Trader and E-2 Treaty Investor visas are available to citizens of countries that have commerce and navigation treaties with the United States. Any income earned in the U.S. by these visa holders is subject to U.S. taxation. Our team will assist you in navigating the tax filing process to ensure compliance.